Navigating the Southwest Stock: Comprehensive Guide for Investors

Introduction

Southwest stock has been a point of interest for many investors due to the company’s consistent performance and growth in the airline industry. Understanding the dynamics of Southwest stock can help investors make informed decisions. This comprehensive guide aims to cover all aspects of investing in Southwest stock, from market analysis to strategic planning.

Overview of Southwest Airlines

Southwest Airlines, known for its low-cost flights and customer-friendly policies, has a significant presence in the airline industry. The company’s performance directly impacts Southwest stock, making it essential for investors to understand its operational strategies, financial health, and market position.

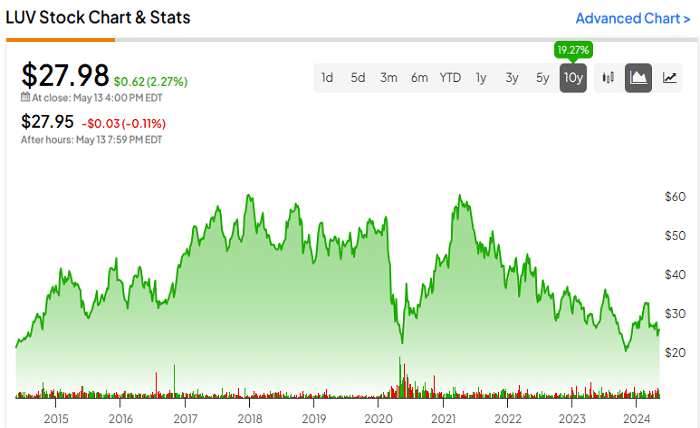

Historical Performance of Southwest Stock

Southwest stock has shown resilience over the years, with notable peaks and troughs. By analyzing historical data, investors can gain insights into how external factors such as economic downturns, fuel prices, and industry competition have influenced Southwest stock.

Financial Health of Southwest Airlines

The financial health of Southwest Airlines is a critical factor for investors. Key financial metrics such as revenue growth, profit margins, and debt levels directly impact Southwest stock. Detailed analysis of financial statements can reveal the company’s capacity to sustain growth and weather economic challenges.

Impact of Economic Factors

Economic factors, including GDP growth, inflation rates, and consumer spending, play a significant role in determining the performance of Southwest stock. Investors should monitor these macroeconomic indicators to predict potential fluctuations in Southwest stock prices.

Competitive Landscape

Southwest Airlines operates in a highly competitive environment. Analyzing the competitive landscape helps in understanding how market share, pricing strategies, and service offerings affect Southwest stock. The company’s ability to differentiate itself from competitors is crucial for its stock performance.

Market Trends and Predictions

Keeping an eye on market trends and predictions is vital for investors in Southwest stock. Analysts’ forecasts, industry reports, and market sentiment can provide valuable insights into future stock performance. Understanding these trends helps in making informed investment decisions.

Dividend Policy and Its Impact

Southwest stock’s dividend policy can be a significant factor for income-focused investors. Examining the company’s history of dividend payments, yield, and growth rate can indicate the potential for stable income from investing in Southwest stock.

Management and Leadership

The leadership and management style of Southwest Airlines greatly influence its strategic direction and, consequently, Southwest stock. Investors should evaluate the experience and track record of the company’s executives to assess their ability to drive growth and innovation.

Sustainability and Corporate Responsibility

Southwest Airlines’ commitment to sustainability and corporate responsibility can impact investor sentiment and, ultimately, Southwest stock. Initiatives in reducing carbon emissions, community engagement, and ethical business practices are increasingly important to modern investors.

Impact of Fuel Prices

Fuel prices are a major operational cost for airlines and have a direct impact on Southwest stock. Understanding the correlation between fuel price fluctuations and stock performance can help investors anticipate changes in Southwest stock valuation.

Technological Advancements

Technological advancements in the airline industry, such as new aircraft models and digital services, can enhance operational efficiency and customer satisfaction. Investors should consider how Southwest Airlines leverages technology to maintain its competitive edge and boost Southwest stock.

Customer Satisfaction and Brand Loyalty

Customer satisfaction and brand loyalty are critical to the sustained performance of Southwest Airlines. High levels of customer loyalty can lead to repeat business and stable revenue streams, positively impacting Southwest stock.

Risk Factors

Investing in Southwest stock involves understanding the potential risks, including regulatory changes, economic downturns, and operational challenges. Identifying and mitigating these risks is crucial for maintaining a balanced investment portfolio.

Investment Strategies for Southwest Stock

Various investment strategies can be employed when dealing with Southwest stock. From long-term holding to active trading, each strategy has its benefits and risks. Investors need to align their investment approach with their financial goals and risk tolerance.

Conclusion

Southwest stock offers a compelling investment opportunity given the company’s strong market position, financial health, and strategic initiatives. By staying informed about the various factors influencing Southwest stock, investors can make well-informed decisions and potentially achieve substantial returns.

FAQs

1. What are the key factors influencing Southwest stock? The key factors include the company’s financial health, market trends, economic conditions, competitive landscape, and operational efficiency.

2. How does the dividend policy of Southwest Airlines impact its stock? Southwest Airlines’ dividend policy provides income to shareholders and can indicate the company’s financial stability and profitability, affecting investor confidence and stock value.

3. What risks should investors consider when investing in Southwest stock? Investors should consider risks such as economic downturns, fuel price volatility, regulatory changes, and competition within the airline industry.

4. How can economic factors impact Southwest stock? Economic factors like GDP growth, inflation rates, and consumer spending directly affect the airline industry, influencing Southwest stock prices through demand fluctuations and cost variations.

5. What role does customer satisfaction play in the performance of Southwest stock? High customer satisfaction leads to brand loyalty and repeat business, contributing to stable revenue and positive impacts on Southwest stock valuation.