Investment Account: A Comprehensive Guide to Building Wealth

An investment account is a gateway to growing wealth, offering various financial instruments for short- and long-term goals. Whether you are new to investing or an experienced trader, understanding how investment accounts work is crucial to maximizing your financial potential. In this blog post, we will explore everything you need to know about investment accounts, from types and benefits to choosing the right account and strategies for success.

What Is an Investment Account?

An investment account is a financial account designed for holding securities such as stocks, bonds, mutual funds, ETFs, and more. Unlike traditional savings accounts, investment accounts offer the potential for higher returns through market participation.

With an investment account, individuals can grow their money by leveraging financial markets while managing risks based on their investment goals and risk tolerance.

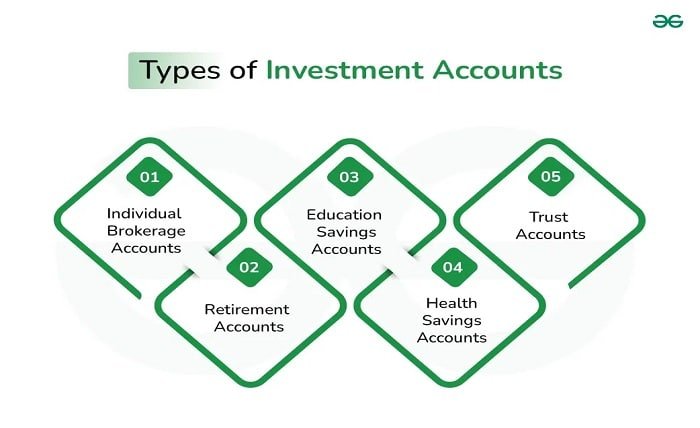

Types of Investment Accounts

Understanding the types of investment accounts is essential to selecting one that aligns with your financial objectives.

- Brokerage Accounts: These accounts allow you to buy and sell securities such as stocks, bonds, and ETFs without restrictions on withdrawals.

- Retirement Accounts: Examples include IRAs (Individual Retirement Accounts) and 401(k)s, which offer tax advantages for long-term retirement savings.

- Education Savings Accounts: Designed for educational expenses, accounts like 529 plans grow tax-free if used for qualified education costs.

- Managed Accounts: These are professionally managed accounts where financial advisors handle your investments for a fee.

- Taxable vs. Tax-Advantaged Accounts: Some accounts, like traditional brokerage accounts, are taxable, while others, such as IRAs, offer tax benefits.

Choosing the right type of investment account depends on your financial goals, timeline, and tax considerations.

Benefits of Having an Investment Account

Opening an investment account can significantly enhance your financial stability and future growth. Key benefits include:

- Wealth Accumulation: Investment accounts provide an opportunity for compounding returns, helping your money grow exponentially over time.

- Diversification: Holding various assets in your investment account reduces risk by spreading investments across different financial instruments.

- Tax Advantages: Some accounts, like IRAs and 401(k)s, offer tax-deferred or tax-free growth, enhancing long-term returns.

- Flexibility: Investment accounts cater to different needs, from short-term gains to long-term retirement planning.

- Customizability: Choose investments based on your risk tolerance, time horizon, and personal financial goals.

How to Open an Investment Account

Setting up an investment account is a straightforward process, but it requires careful consideration. Follow these steps to open your account:

- Choose a Provider: Select a reputable financial institution or brokerage firm that aligns with your needs.

- Determine the Account Type: Decide whether you need a taxable brokerage account, a retirement account, or another type.

- Complete the Application: Provide necessary personal information, including your Social Security Number and employment details.

- Fund Your Account: Deposit an initial amount to start investing. Many providers have no minimum deposit requirements.

- Select Investments: Choose from stocks, bonds, ETFs, or mutual funds based on your financial goals and risk tolerance.

Opening an investment account is the first step toward achieving financial independence.

Strategies for Maximizing Your Investment Account

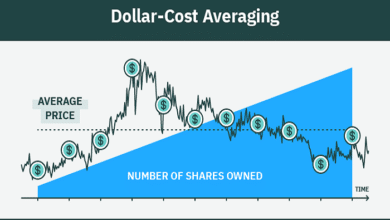

To get the most out of your investment account, employ effective strategies:

- Diversify Your Portfolio: Spread your investments across asset classes to minimize risk.

- Invest for the Long Term: Avoid emotional decisions and focus on long-term growth.

- Reinvest Dividends: Use dividends to buy more shares and benefit from compounding.

- Monitor Your Account: Regularly review your investments to ensure alignment with your goals.

- Stay Educated: Keep up with market trends and adjust your strategy as needed.

A disciplined approach ensures your investment account remains a powerful tool for wealth creation.

Risks Associated with Investment Accounts

Every investment account comes with inherent risks, and understanding them is essential to making informed decisions.

- Market Risk: Prices of securities can fluctuate due to market conditions, leading to potential losses.

- Liquidity Risk: Certain assets may be difficult to sell quickly without a loss.

- Credit Risk: Bonds and fixed-income securities carry the risk of default by the issuer.

- Inflation Risk: Over time, inflation may erode the purchasing power of your returns.

- Emotional Risk: Acting on fear or greed can result in poor investment decisions.

By diversifying your portfolio and maintaining a balanced approach, you can mitigate these risks and make your investment account work for you.

How to Choose the Right Investment Account

Choosing the right investment account depends on factors like financial goals, risk tolerance, and time horizon. Here’s a quick guide:

- Short-Term Goals: A taxable brokerage account offers liquidity and flexibility.

- Retirement Planning: IRAs or 401(k)s are ideal for long-term savings with tax advantages.

- Saving for Education: 529 plans and similar accounts provide targeted benefits for educational expenses.

- Wealth Management: Managed accounts are suitable for those seeking professional assistance.

By assessing your needs and objectives, you can select the investment account that best suits your circumstances.

Conclusion

An investment account is an indispensable tool for anyone looking to build wealth and secure financial stability. From understanding different types of accounts to leveraging effective strategies, a well-managed investment account can help you achieve your financial dreams. Whether you’re saving for retirement, education, or general wealth accumulation, the key is to stay informed, disciplined, and proactive in managing your investments.

FAQs

1. What is an investment account?

An investment account is a financial account used to hold and grow assets like stocks, bonds, mutual funds, and ETFs.

2. How do I open an investment account?

To open an investment account, choose a provider, decide on the account type, complete an application, fund your account, and select your investments.

3. Are investment accounts risky?

Yes, investment accounts carry risks like market fluctuations, credit risk, and inflation. Diversification and informed decisions can mitigate these risks.

4. What is the best investment account for retirement?

For retirement, IRAs and 401(k)s are excellent options due to their tax advantages and long-term growth potential.

5. Can I withdraw money from my investment account anytime?

It depends on the account type. While taxable accounts allow withdrawals anytime, retirement accounts may impose penalties for early withdrawals.