Best Stocks to Invest In: A Comprehensive Guide for Investors

Investing in the stock market can be a rewarding way to build wealth over time. With so many opportunities available, however, the key challenge is identifying which stocks offer the best potential for growth. The phrase “best stocks to invest in” is often searched by both novice and experienced investors alike, but the answer can vary depending on market conditions, investment goals, and personal preferences. In this guide, we will explore the best stocks to invest in, breaking down essential strategies, sectors to watch, and how to make informed decisions based on your risk tolerance and investment horizon.

What Are the Best Stocks to Invest In?

The term “best stocks to invest in” refers to stocks that have high growth potential, a solid track record, and the ability to deliver substantial returns over time. Selecting the best stocks to invest in requires careful research, an understanding of market trends, and an analysis of a company’s financial health. Typically, investors look for companies that demonstrate consistent profitability, innovative products or services, and leadership in their respective industries.

When considering the best stocks to invest in, it’s crucial to focus on long-term performance and avoid chasing short-term gains. While stock markets can be volatile, focusing on solid fundamentals, growth potential, and a well-diversified portfolio will position investors for success. With so many sectors and individual stocks to choose from, let’s dive into some of the best stocks to invest in today.

How to Choose the Best Stocks to Invest In

Before diving into specific recommendations, it’s essential to understand how to choose the best stocks to invest in. Several factors should influence your decision-making process:

- Company Fundamentals:

A strong balance sheet, consistent revenue growth, and a healthy profit margin are key indicators of a company’s long-term viability. Always assess a company’s earnings reports, financial statements, and overall performance history. - Industry Trends:

Some sectors outperform others based on economic conditions, consumer trends, or technological advancements. For example, technology and renewable energy stocks have been gaining traction in recent years. - Risk Tolerance:

Every investor has a different level of risk tolerance. The best stocks to invest in for one person may not be suitable for another, depending on individual financial goals and willingness to take on risk. - Market Valuation:

Look for stocks that are trading at reasonable valuations. This can be determined by examining price-to-earnings (P/E) ratios, dividend yields, and other key metrics. Overvalued stocks might carry more risk in the long run. - Growth Potential:

Look for companies with strong growth prospects, such as those in emerging industries or those introducing innovative products. These stocks may have higher volatility but offer the potential for significant returns.

The Best Stocks to Invest In for Long-Term Growth

For long-term investors, it’s crucial to identify companies that have the potential for sustainable growth over many years. Here are some of the best stocks to invest in for long-term gains:

- Apple Inc. (AAPL):

Apple has consistently been one of the best stocks to invest in due to its robust product lineup, including the iPhone, iPad, and Mac. The company’s brand loyalty, recurring revenue streams (like from the App Store and subscription services), and innovation ensure that it remains a top pick for investors focused on long-term growth. - Amazon.com Inc. (AMZN):

Amazon’s dominance in e-commerce, cloud computing (via AWS), and other growth sectors has made it one of the best stocks to invest in. With a vast customer base and a commitment to innovation, Amazon’s stock has consistently delivered strong returns for its investors. - Microsoft Corporation (MSFT):

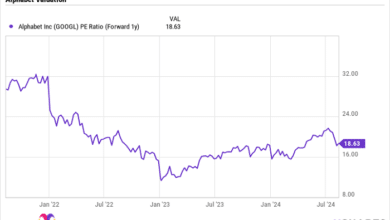

Microsoft is another tech giant that remains a prime option for long-term investors. Its cloud computing services, software products, and commitment to AI and cybersecurity make Microsoft a strong contender among the best stocks to invest in for those seeking steady growth. - Alphabet Inc. (GOOGL):

As the parent company of Google, Alphabet continues to dominate the digital advertising market. With investments in artificial intelligence, self-driving cars, and other high-growth technologies, Alphabet is poised to remain a top stock for the long term. - Tesla Inc. (TSLA):

Tesla’s innovation in electric vehicles and renewable energy solutions has made it one of the best stocks to invest in, particularly for those looking for growth in the green energy sector. Though volatile, its potential for disruption in multiple industries continues to attract investors.

The Best Stocks to Invest In for Dividends

For income-focused investors, dividend-paying stocks can provide a steady income stream in addition to capital appreciation. Here are some of the best stocks to invest in if you’re seeking dividend income:

- Johnson & Johnson (JNJ):

A healthcare powerhouse, Johnson & Johnson has a long history of paying dividends and is known for its stability in the pharmaceutical, medical device, and consumer health sectors. - Procter & Gamble Co. (PG):

P&G is a consumer goods giant with iconic brands such as Tide, Pampers, and Gillette. The company has consistently raised its dividend and is a reliable option for dividend-seeking investors. - Coca-Cola Company (KO):

Coca-Cola is one of the best stocks to invest in for those looking for both steady dividends and global brand recognition. The company has a long history of paying dividends, making it a favorite among dividend investors. - PepsiCo Inc. (PEP):

PepsiCo, with its diverse portfolio of beverages and snacks, offers another solid option for dividend investors. Its strong cash flow and global presence ensure that PepsiCo remains one of the top dividend stocks. - McDonald’s Corporation (MCD):

McDonald’s is another reliable dividend stock, known for its resilience in all market conditions. Its extensive global reach and strong brand make it a top pick for those seeking regular income through dividends.

The Best Stocks to Invest In for Short-Term Gains

For those with a shorter investment horizon, focusing on stocks that have the potential for quick growth and high returns is essential. These are often riskier but can provide substantial profits in the short term. Here are some of the best stocks to invest in for short-term gains:

- NVIDIA Corporation (NVDA):

NVIDIA has seen significant growth due to the rise of gaming, AI, and data centers. Its stock has been volatile, but it offers massive upside potential for those looking for short-term gains. - Shopify Inc. (SHOP):

As an e-commerce platform that enables businesses to create online stores, Shopify has experienced impressive growth. For short-term investors, the stock is a strong pick due to its scalability and position in a high-demand industry. - AMD (Advanced Micro Devices, Inc.):

AMD has grown rapidly due to its competitive advantage in semiconductors. With strong performance in both the gaming and server markets, AMD presents a high-risk, high-reward opportunity for short-term investors. - Square Inc. (SQ):

Square’s focus on financial technology, including payment processing and its Cash App, positions it well for short-term gains. The company’s innovative solutions and the expansion of digital payments have led to substantial stock price increases. - Zoom Video Communications (ZM):

With the rise of remote work, Zoom saw explosive growth during the pandemic. While its growth has slowed somewhat, its stock still offers potential for short-term traders looking to capitalize on fluctuations in stock price.

Sector-Based Best Stocks to Invest In

Different sectors of the economy can provide varying opportunities for growth and risk. Understanding the best sectors to invest in will help guide your decisions on which stocks to consider. Here are some of the top sectors and stocks to invest in:

- Technology:

Technology stocks like Apple, Microsoft, and NVIDIA remain among the best to invest in due to the rapid pace of innovation. Cloud computing, AI, and semiconductors are key drivers of growth in this sector. - Healthcare:

Healthcare stocks like Johnson & Johnson, Pfizer, and Merck offer stability, especially for long-term investors. The industry is set for growth due to advancements in biotechnology and pharmaceuticals. - Renewable Energy:

As the world shifts towards sustainability, renewable energy companies like NextEra Energy (NEE) and Enphase Energy (ENPH) are poised for growth. These stocks cater to the increasing demand for clean energy. - Consumer Goods:

Companies in the consumer goods sector, like Procter & Gamble and Coca-Cola, offer steady dividends and strong growth prospects, making them a safe bet for conservative investors. - Financials:

Banks and financial institutions like JPMorgan Chase (JPM) and Bank of America (BAC) can provide substantial returns, especially during periods of economic recovery. The sector is poised to benefit from rising interest rates and economic growth.

The Risks of Investing in Stocks and How to Mitigate Them

While investing in the best stocks offers substantial rewards, it’s important to acknowledge the risks involved. Stock prices can be volatile, and market fluctuations can lead to significant losses. Here are some strategies to mitigate these risks:

- Diversification:

Diversifying your portfolio across different sectors and asset classes can help reduce risk. By investing in a range of stocks, you protect yourself from the poor performance of any one company. - Research:

Thoroughly researching stocks before investing is essential. Stay informed about market trends, industry developments, and company performance to make sound decisions. - Risk Management:

Set stop-loss orders and monitor your investments regularly. This helps protect against substantial losses if a stock’s price declines sharply. - Invest for the Long-Term:

Stock market volatility tends to even out over time. By investing with a long-term horizon, you can ride out market fluctuations and focus on the growth potential of your investments. - Stay Informed:

Continuously monitor your investments and stay updated on news related to your stocks. This allows you to react to market changes and make informed decisions.

Conclusion

Identifying the best stocks to invest in is an ongoing process that requires research, patience, and an understanding of your financial goals. Whether you’re seeking long-term growth, dividend income, or short-term gains, there are numerous options available across various sectors of the economy. By staying informed, diversifying your portfolio, and carefully selecting stocks that align with your risk tolerance and investment objectives, you can build a successful investment strategy. Always remember that stock investing carries inherent risks, and the best stocks to invest in will vary depending on market conditions and personal preferences. By making thoughtful, informed decisions, you can set yourself on a path to financial success.

FAQs

- What are the best stocks to invest in for long-term growth?

Companies like Apple, Amazon, Microsoft, Alphabet, and Tesla are often considered some of the best stocks to invest in for long-term growth due to their market leadership and innovation. - How do I know which stocks are the best to invest in?

Look for companies with strong fundamentals, consistent profitability, growth potential, and favorable market conditions. Researching financial statements and industry trends is crucial. - What are the best dividend stocks to invest in?

Dividend stocks like Johnson & Johnson, Procter & Gamble, Coca-Cola, and McDonald’s are known for their reliable income streams and consistent dividend payments. - Can I invest in stocks for short-term gains?

Yes, stocks like NVIDIA, Shopify, and Zoom can offer short-term gains due to their volatility and potential for quick growth. However, these investments come with higher risk. - How can I mitigate risks when investing in stocks?

Diversification, thorough research, setting stop-loss orders, and maintaining a long-term investment strategy are effective ways to mitigate the risks associated with stock investing.