Best Mutual Funds to Invest In: A Complete Guide for Smart Investors

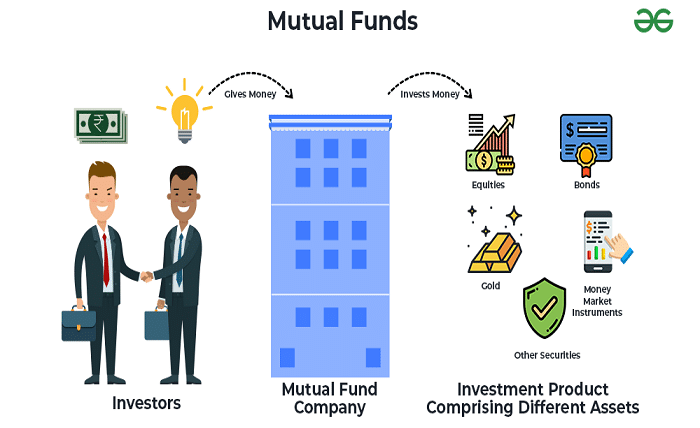

Mutual funds to invest in are professionally managed investment funds that pool money from multiple investors to buy a diversified portfolio of stocks, bonds, or other securities. They offer a convenient and efficient way for investors to achieve financial goals, whether short-term or long-term. By choosing the right mutual funds to invest in, you can maximize your wealth and secure your financial future.

Why Should You Consider Mutual Funds to Invest In?

There are several reasons why mutual funds to invest in are an excellent choice for investors. These funds offer diversification, reducing risk by spreading investments across various assets. They are also managed by experienced fund managers who make strategic decisions to optimize returns. Additionally, mutual funds to invest in provide liquidity, tax benefits, and the flexibility to invest with small amounts, making them accessible to all types of investors.

Types of Mutual Funds to Invest In

Before selecting mutual funds to invest in, it’s essential to understand the different types available. Here are some of the most common categories:

- Equity Mutual Funds – Best for long-term growth by investing in stocks.

- Debt Mutual Funds – Suitable for low-risk investors looking for stable returns.

- Hybrid Mutual Funds – A mix of equity and debt to balance risk and reward.

- Index Funds – Passive funds that mimic market indices.

- Sectoral Funds – Focus on specific industries like technology or healthcare.

- ELSS (Equity Linked Savings Scheme) – Offers tax benefits under Section 80C.

- Liquid Funds – Ideal for short-term investments with high liquidity.

Choosing the right type of mutual funds to invest in depends on your risk tolerance, investment horizon, and financial objectives.

Top Performing Mutual Funds to Invest In

Selecting the best mutual funds to invest in requires thorough research and understanding of market trends. Here are some of the top-performing mutual funds across different categories:

Best Equity Mutual Funds to Invest In

- XYZ Bluechip Fund – Consistently delivers high returns.

- ABC Mid-Cap Fund – Ideal for aggressive investors seeking growth.

- LMN Small-Cap Fund – High risk, high return potential.

Best Debt Mutual Funds to Invest In

- DEF Short-Term Debt Fund – Low risk with steady returns.

- GHI Corporate Bond Fund – Offers stability and security.

- JKL Government Securities Fund – Ideal for risk-averse investors.

Best Hybrid Mutual Funds to Invest In

- MNO Balanced Advantage Fund – Adjusts dynamically between equity and debt.

- PQR Aggressive Hybrid Fund – Higher exposure to equities for better growth.

- STU Conservative Hybrid Fund – Lower risk with stable performance.

How to Choose the Best Mutual Funds to Invest In?

To select the right mutual funds to invest in, consider the following factors:

- Investment Goals – Define whether you need short-term liquidity or long-term growth.

- Risk Tolerance – Higher risk funds yield better returns, while low-risk funds ensure stability.

- Fund Performance – Analyze past performance but remember that it does not guarantee future results.

- Expense Ratio – Lower expense ratios mean higher returns over time.

- Fund Manager Expertise – Experienced fund managers make strategic investment decisions.

By carefully evaluating these factors, you can choose the best mutual funds to invest in based on your financial needs.

Benefits of Investing in Mutual Funds to Invest In

Mutual funds to invest in come with several advantages that make them a preferred investment choice:

- Diversification – Spreads investment risk across various assets.

- Professional Management – Experts handle your investments for optimal returns.

- Liquidity – You can redeem your funds whenever needed.

- Affordability – Start investing with as little as $10.

- Tax Benefits – Certain mutual funds offer tax-saving options.

- Systematic Investment Plans (SIPs) – Invest small amounts regularly to build wealth over time.

Understanding these benefits will help you make informed decisions when choosing mutual funds to invest in.

Common Mistakes to Avoid When Investing in Mutual Funds to Invest In

Even experienced investors sometimes make mistakes when selecting mutual funds to invest in. Here are some pitfalls to avoid:

- Investing Without Research – Always analyze fund performance and risk factors.

- Chasing Past Performance – Just because a fund performed well in the past doesn’t mean it will in the future.

- Ignoring Expense Ratios – High expenses can eat into your profits.

- Not Diversifying Enough – Over-concentration in one type of fund increases risk.

- Emotional Decision-Making – Avoid panic-selling during market downturns.

Being aware of these mistakes will help you make smarter choices when investing in mutual funds to invest in.

Conclusion

Choosing the best mutual funds to invest in is crucial for financial growth and stability. By understanding different fund types, evaluating performance, and considering key factors like risk tolerance and investment goals, you can make informed decisions. Whether you’re a beginner or an experienced investor, mutual funds to invest in offer a powerful way to grow your wealth while managing risks effectively.

FAQs

1. What are the best mutual funds to invest in for beginners?

Beginners should consider index funds, balanced funds, or large-cap equity funds for stable returns and lower risk.

2. How much should I invest in mutual funds?

The amount depends on your financial goals, risk tolerance, and investment horizon. You can start with as little as $10 through SIPs.

3. Are mutual funds to invest in safe?

Mutual funds carry some risk, but diversification and professional management reduce potential losses.

4. Can I withdraw money from mutual funds anytime?

Yes, most mutual funds allow withdrawals at any time, except for ELSS funds, which have a three-year lock-in period.

5. How long should I stay invested in mutual funds?

Long-term investment (5-10 years) in mutual funds generally yields better returns, though short-term options are available too.