Comprehensive Analysis of CDE Stock: Opportunities and Risks

Introduction

Investing in stocks requires thorough research and analysis to make informed decisions. One stock that has garnered attention in the mining sector is CDE stock. This blog post provides a detailed analysis of CDE stock, covering its history, performance, and the factors that influence its market value.

The History of CDE Stock

CDE stock represents Coeur Mining, Inc., a well-established company in the mining industry. Founded in the early 20th century, Coeur Mining has grown to become a significant player in silver and gold mining, with CDE stock reflecting its market presence.

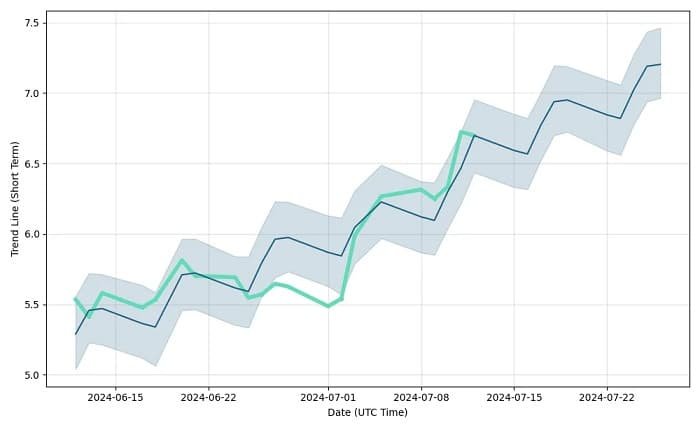

CDE Stock Performance Over the Years

Over the decades, CDE stock has experienced fluctuations influenced by various market factors. Historically, the stock has shown resilience and growth potential, making it a point of interest for investors. Understanding the historical performance of CDE stock helps in predicting future trends.

Market Trends Influencing CDE Stock

Market trends play a crucial role in determining the performance of CDE stock. Factors such as commodity prices, economic stability, and global demand for precious metals significantly impact the stock’s value. Investors must stay informed about these trends to make strategic decisions regarding CDE stock.

Financial Health of Coeur Mining

Analyzing the financial health of Coeur Mining is essential for evaluating CDE stock. The company’s revenue, profit margins, debt levels, and overall financial stability are critical indicators of the stock’s potential. A strong financial foundation can positively influence CDE stock’s market performance.

Competitive Landscape

The competitive landscape within the mining industry also affects CDE stock. Coeur Mining operates in a highly competitive environment, with other major players vying for market share. Understanding how CDE stock stands against its competitors provides valuable insights for investors.

Investment Strategies for CDE Stock

Investors have various strategies at their disposal when it comes to CDE stock. Whether adopting a long-term investment approach or engaging in short-term trading, each strategy requires careful consideration of market conditions and the stock’s historical performance.

Risks Associated with CDE Stock

Investing in CDE stock, like any other stock, carries certain risks. Market volatility, regulatory changes, and operational challenges can impact the stock’s value. Identifying and understanding these risks is crucial for mitigating potential losses and making informed investment decisions.

The Role of Commodity Prices

Commodity prices, particularly silver and gold, have a direct impact on CDE stock. Fluctuations in these prices can lead to significant changes in the stock’s market value. Investors should monitor commodity markets closely to anticipate movements in CDE stock.

Technological Advancements and CDE Stock

Technological advancements in mining can influence the performance of CDE stock. Innovations that enhance operational efficiency and reduce costs can positively impact the company’s profitability and, consequently, the stock’s value.

Environmental and Social Governance (ESG) Factors

ESG factors are becoming increasingly important in investment decisions. Coeur Mining’s commitment to sustainable practices and social responsibility can affect investor perception and, ultimately, the performance of CDE stock.

Analyst Ratings and CDE Stock

Analyst ratings provide valuable insights into CDE stock. Financial analysts evaluate the company’s performance, market conditions, and future prospects to provide recommendations. Investors often consider these ratings when making decisions about buying or selling CDE stock.

Future Prospects of CDE Stock

The future prospects of CDE stock depend on various factors, including market conditions, company performance, and global economic trends. Staying informed about these elements helps investors anticipate potential changes in the stock’s value and make strategic decisions.

Conclusion

Investing in CDE stock offers opportunities and risks. By understanding the history, performance, and factors influencing CDE stock, investors can make informed decisions. Whether considering long-term investments or short-term trading, thorough research and strategic planning are essential.

FAQs

1. What is CDE stock? CDE stock represents shares of Coeur Mining, Inc., a company specializing in silver and gold mining.

2. How has CDE stock performed historically? Historically, CDE stock has shown resilience and growth potential, with performance influenced by market trends and commodity prices.

3. What factors influence the value of CDE stock? Factors include commodity prices, market trends, financial health of Coeur Mining, competitive landscape, and technological advancements.

4. What are the risks associated with investing in CDE stock? Risks include market volatility, regulatory changes, operational challenges, and fluctuations in commodity prices.

5. How can I make informed investment decisions regarding CDE stock? Making informed decisions requires thorough research, understanding market trends, monitoring commodity prices, and considering analyst ratings.