Dollar Cost Averaging: A Smart Investment Strategy for Beginners and Experts

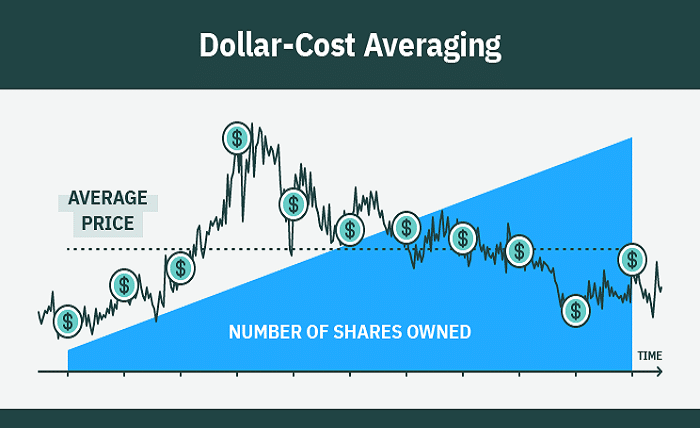

Dollar cost averaging is a timeless investment strategy that offers a systematic approach to building wealth. It’s a method that involves investing a fixed amount of money at regular intervals, regardless of market conditions. By spreading out investments over time, dollar cost averaging minimizes the impact of market volatility and reduces the emotional stress often associated with investing. In this blog post, we’ll explore the ins and outs of dollar cost averaging, its benefits, and how to use it effectively.

What is Dollar Cost Averaging?

Dollar cost averaging, often abbreviated as DCA, is an investment strategy where an investor divides their total investment amount into smaller, regular contributions. These contributions are made at predetermined intervals, such as weekly, monthly, or quarterly, and are used to purchase assets like stocks, mutual funds, or cryptocurrencies.

By investing consistently, dollar cost averaging allows investors to buy more shares when prices are low and fewer shares when prices are high. This approach helps average out the cost of investments over time, reducing the risk of making large investments at unfavorable market conditions.

How Does Dollar Cost Averaging Work?

To understand how dollar cost averaging works, imagine you have $1,200 to invest over a year. Instead of investing the entire amount in one go, you decide to invest $100 every month.

Here’s what happens:

- Month 1: The stock price is $10, so you buy 10 shares.

- Month 2: The stock price drops to $8, so you buy 12.5 shares.

- Month 3: The stock price rises to $12, so you buy 8.33 shares.

Over time, the average cost per share balances out, reducing the impact of market fluctuations. This is the core principle of dollar cost averaging: mitigating risk by spreading investments over time.

Benefits of Dollar Cost Averaging

1. Reduces Market Timing Risk

One of the biggest challenges in investing is timing the market perfectly. Dollar cost averaging eliminates the need to predict market highs and lows by investing regularly, regardless of price.

2. Encourages Discipline

Dollar cost averaging promotes consistent investing habits. By automating contributions, it helps investors stay committed to their financial goals.

3. Minimizes Emotional Investing

Market volatility can trigger fear and greed, leading to poor investment decisions. Dollar cost averaging reduces emotional bias by following a set schedule.

4. Makes Investing Accessible

With dollar cost averaging, you don’t need a large sum of money to start investing. Regular small contributions make investing more accessible to everyone.

Dollar Cost Averaging vs. Lump-Sum Investing

While dollar cost averaging has its advantages, how does it compare to lump-sum investing?

- Dollar Cost Averaging: Spreads out investments over time, reducing risk. Ideal for volatile markets and for those who prioritize risk management.

- Lump-Sum Investing: Involves investing a large amount all at once. This approach can yield higher returns in rising markets but comes with higher risk.

The choice between dollar cost averaging and lump-sum investing depends on your risk tolerance, financial goals, and market outlook. For long-term investors, dollar cost averaging is often the preferred choice due to its ability to smooth out market fluctuations.

Dollar Cost Averaging in Different Asset Classes

Dollar cost averaging isn’t limited to stocks. It can be applied to various asset classes, including:

1. Stocks and ETFs

Investing in individual stocks or exchange-traded funds (ETFs) through dollar cost averaging is a popular choice. It allows investors to take advantage of market dips without worrying about timing.

2. Mutual Funds

Dollar cost averaging works seamlessly with mutual funds, where regular contributions are used to purchase fund units. This approach aligns well with retirement savings plans.

3. Cryptocurrencies

In the highly volatile cryptocurrency market, dollar cost averaging helps investors navigate price swings and build their portfolio steadily.

How to Implement Dollar Cost Averaging

Implementing dollar cost averaging is simple and effective. Follow these steps to get started:

- Determine Your Budget: Decide how much you can afford to invest regularly.

- Choose an Asset: Select the asset you want to invest in, such as stocks, ETFs, or mutual funds.

- Set a Schedule: Choose a consistent schedule for your investments (e.g., monthly or bi-weekly).

- Automate Your Contributions: Use a brokerage or investment platform to automate your investments.

- Stay Consistent: Stick to your plan, regardless of market conditions.

By following these steps, you can leverage the benefits of dollar cost averaging and build wealth over time.

Real-Life Examples of Dollar Cost Averaging Success

Many successful investors have used dollar cost averaging to their advantage. For instance:

- Retirement Savings: Employees contributing to a 401(k) or similar retirement account are effectively using dollar cost averaging by making regular contributions.

- Stock Market Investors: Long-term investors who consistently buy index funds or blue-chip stocks often outperform those who attempt to time the market.

- Crypto Enthusiasts: In the volatile world of cryptocurrencies, dollar cost averaging has helped many investors build substantial portfolios without succumbing to market panic.

These examples highlight the versatility and effectiveness of dollar cost averaging in different investment scenarios.

Conclusion

Dollar cost averaging is a powerful investment strategy that provides a structured, disciplined approach to building wealth. By spreading investments over time, it minimizes risk, reduces emotional decision-making, and makes investing accessible to everyone. Whether you’re a seasoned investor or just starting, dollar cost averaging is a valuable tool for achieving long-term financial goals.

As with any strategy, it’s essential to align dollar cost averaging with your financial objectives and consult with a financial advisor when needed. With patience and consistency, dollar cost averaging can help you navigate the complexities of the investment world with confidence.

FAQs

1. What is dollar cost averaging?

Dollar cost averaging is an investment strategy where you invest a fixed amount of money at regular intervals, regardless of market conditions.

2. Is dollar cost averaging better than lump-sum investing?

Dollar cost averaging reduces risk and is ideal for volatile markets, while lump-sum investing may yield higher returns in rising markets.

3. Which assets are suitable for dollar cost averaging?

Dollar cost averaging works well with stocks, ETFs, mutual funds, and even cryptocurrencies.

4. Can beginners use dollar cost averaging?

Yes, dollar cost averaging is beginner-friendly, as it allows for small, regular contributions and reduces the need for market timing.

5. What are the risks of dollar cost averaging?

While dollar cost averaging reduces risk, it may lead to missed opportunities in rapidly rising markets compared to lump-sum investing.