Introduction

FAZ stock, or the Direxion Daily Financial Bear 3X Shares, offers a unique investment opportunity for those looking to capitalize on declines in the financial sector. This leveraged ETF is designed to provide three times the inverse exposure to an index of US financial stocks. In this post, we’ll delve deep into what FAZ stock is, how it works, and the strategies investors can use to integrate it into their portfolios.

What is FAZ Stock?

FAZ stock is a leveraged exchange-traded fund (ETF) created by Direxion. It aims to return three times the inverse of the daily performance of the Russell 1000 Financial Services Index. This means if the index decreases by 1%, FAZ stock aims to increase by 3%, before fees and expenses. Understanding the structure and goal of FAZ stock is crucial for any investor considering it as part of their investment strategy.

How Does FAZ Stock Work?

Leveraged ETFs like FAZ stock use financial derivatives such as futures and swaps to amplify the returns of an underlying index. It’s important for potential investors in FAZ stock to understand that this mechanism works on a daily basis, which leads to compounding effects if held for more than a day.

The Risks of Investing in FAZ Stock

Investing in FAZ stock involves significant risks due to its leveraged nature. The primary risk is the magnification of losses. If the financial index rises, the losses in FAZ stock can be substantial and rapid. It’s also sensitive to the volatility of the market, which can enhance the risks further.

The Ideal Investor for FAZ Stock

FAZ stock is most suitable for experienced investors who understand the complexities of leveraged ETFs and can monitor their investments closely. It is typically used for short-term trades rather than long-term investment strategies due to its daily reset.

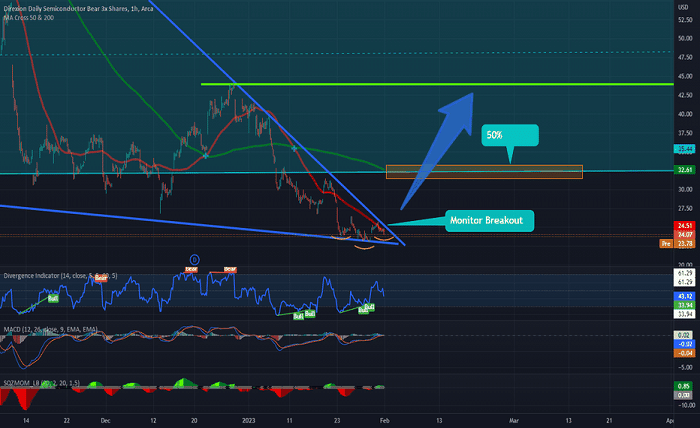

Historical Performance Analysis

Reviewing the historical performance of FAZ stock can provide insights into its volatility and potential returns. Like many leveraged ETFs, FAZ stock can experience high peaks and deep troughs, reflecting the volatile nature of the financial sectors it inversely tracks.

How to Invest in FAZ Stock

Investing in FAZ stock is similar to buying other stocks or ETFs, typically through a brokerage account. Potential investors should consider the timing of their trades and the market conditions, as FAZ stock’s performance is heavily influenced by daily market movements.

Timing the Market with FAZ Stock

Due to its design, FAZ stock can be a powerful tool for timing the market, especially in anticipation of downturns in the financial sector. However, timing the market requires skill, luck, and thorough research.

Read more about kibho login

FAZ Stock and Day Trading

Day traders often use FAZ stock because of its high liquidity and potential for significant day-to-day gains. Understanding the intricacies of day trading, including the tax implications and brokerage fees, is crucial for anyone considering this approach.

Long-Term Considerations for FAZ Stock

While FAZ stock is generally used for short-term trading strategies, long-term investors might consider it as a hedge against financial sector downturns. However, due to its daily reset, long-term holding can be risky and unpredictable.

Hedging with FAZ Stock

FAZ stock can serve as a hedge for investors with significant exposure to financial stocks. By inversely tracking the financial sector, it provides a counterbalance to losses in a financial downturn.

Comparing FAZ Stock to Other Financial ETFs

Comparing FAZ stock to other financial ETFs, both leveraged and non-leveraged, can help investors understand its unique position in the market. This comparison will highlight the aggressive nature and potential uses of FAZ stock in various investment strategies.

The Impact of Economic Indicators on FAZ Stock

Economic indicators like interest rates, unemployment figures, and GDP growth can significantly impact the financial sector and, consequently, FAZ stock. Investors should stay informed about these indicators to make educated decisions about investing in FAZ stock.

Expert Opinions on FAZ Stock

Financial experts often provide analyses and forecasts for leveraged ETFs like FAZ stock. These insights can be invaluable for understanding the potential future movements and strategies associated with FAZ stock.

Alternatives to FAZ Stock

For those considering FAZ stock but concerned about the risks, there are several alternative investments that offer exposure to the financial sector without the leverage, such as traditional ETFs or individual financial stocks.

Conclusion

FAZ stock, with its triple-leverage inverse strategy, offers a unique but complex investment opportunity within the financial sector. While it can provide substantial returns during financial downturns, it also poses significant risks, especially if held over the long term. Investors considering FAZ stock should be well-versed in market timing, leveraged ETF mechanisms, and risk management strategies to effectively utilize FAZ stock in their investment portfolio.

FAQs

1. What is the main objective of FAZ stock?

FAZ stock aims to provide three times the inverse daily performance of the Russell 1000 Financial Services Index.

2. Who should consider investing in FAZ stock?

FAZ stock is best suited for experienced investors who are capable of managing significant risks and daily market monitoring.

3. Can FAZ stock be used for long-term investments?

Due to its daily reset, FAZ stock is generally recommended for short-term trading as long-term exposure increases risk due to compounding effects.

4. How does economic uncertainty affect FAZ stock?

Economic downturns in the financial sector can lead to gains in FAZ stock due to its inverse relationship with the financial index.

5. Are there safer alternatives to FAZ stock for investing in the financial sector?

Yes, traditional financial ETFs or individual stocks in the financial sector can offer more stability without the associated risks of leverage.