Investing in the stock market can be a powerful way to grow your wealth over time. Whether you’re a seasoned investor or a beginner, finding good stocks to invest in is critical for building a successful portfolio. However, identifying these stocks requires a mix of research, strategy, and understanding of market trends. In this blog, we’ll dive deep into what defines good stocks to invest in, explore strategies for choosing them, and provide insights into some potential picks for your portfolio.

What Are Good Stocks to Invest In?

When considering good stocks to invest in, it’s essential to look for companies with strong fundamentals, consistent growth, and a competitive edge in their industry. These stocks typically exhibit characteristics such as steady revenue growth, strong earnings, low debt, and a history of rewarding investors through dividends or stock buybacks.

Good stocks to invest in often belong to sectors with long-term growth potential, such as technology, healthcare, and renewable energy. Additionally, these stocks tend to be resilient during market downturns, offering a sense of stability for investors.

How to Identify Good Stocks to Invest In

Identifying good stocks to invest in requires a mix of qualitative and quantitative analysis. Here are some steps to guide you:

- Analyze Financial Statements:

Good stocks to invest in typically have strong financials. Look for companies with increasing revenues, positive cash flow, and manageable debt levels. - Evaluate Market Position:

Companies with a solid market position and a competitive advantage are often good stocks to invest in. This includes businesses with strong brand recognition or innovative products. - Examine Growth Potential:

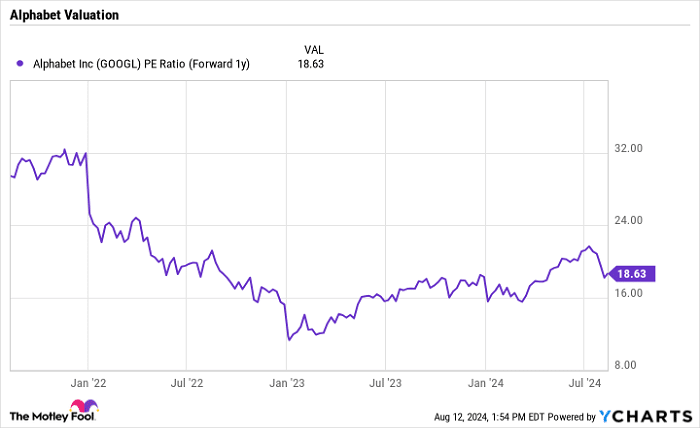

Good stocks to invest in often belong to industries poised for long-term growth. Look for trends like digital transformation or renewable energy adoption. - Check Valuation Metrics:

Use metrics like the price-to-earnings (P/E) ratio or price-to-book (P/B) ratio to determine if a stock is undervalued. Good stocks to invest in often strike a balance between affordability and growth potential. - Assess Dividends:

If you’re seeking income, prioritize stocks with a history of consistent dividend payments. Companies that regularly return profits to shareholders can be good stocks to invest in.

Top Sectors for Good Stocks to Invest In

When looking for good stocks to invest in, certain sectors consistently outperform the market. Here are some sectors to watch:

- Technology:

Tech companies often represent good stocks to invest in because of their potential for innovation and scalability. Giants like Apple, Microsoft, and emerging cloud computing firms are examples. - Healthcare:

The demand for healthcare services and pharmaceuticals ensures this sector remains resilient. Biotech firms and companies specializing in telemedicine are good stocks to invest in. - Renewable Energy:

With increasing global emphasis on sustainability, renewable energy companies are considered good stocks to invest in for long-term growth. - Consumer Staples:

Companies that produce essential goods, such as food and household products, are considered safe bets during economic downturns, making them good stocks to invest in. - Finance:

Banks, insurance companies, and fintech firms are good stocks to invest in, especially when interest rates and economic activity are favorable.

Strategies for Choosing Good Stocks to Invest In

Investing in the right stocks involves strategic planning. Here are some strategies to help you find good stocks to invest in:

- Value Investing:

Look for undervalued stocks with strong fundamentals. Value investing focuses on identifying good stocks to invest in that are trading below their intrinsic value. - Growth Investing:

Focus on companies with above-average growth potential. These are typically good stocks to invest in for long-term capital appreciation. - Dividend Investing:

If steady income is your goal, consider dividend-paying companies. These are often good stocks to invest in for income-oriented portfolios. - Diversification:

Build a diversified portfolio by including stocks from different sectors and industries. This reduces risk while ensuring exposure to good stocks to invest in. - Monitor Market Trends:

Staying updated on market trends helps you identify good stocks to invest in early, giving you a competitive edge.

Examples of Good Stocks to Invest In

While individual stock picks depend on your goals and risk tolerance, here are examples of good stocks to invest in based on recent market performance:

- Apple Inc. (AAPL):

A leader in technology and innovation, Apple is considered one of the best-performing stocks globally. Its consistent product launches and strong financials make it a good stock to invest in. - Tesla Inc. (TSLA):

With its focus on electric vehicles and renewable energy, Tesla represents a futuristic approach to transportation, making it a good stock to invest in for growth-oriented investors. - Johnson & Johnson (JNJ):

Known for its stability and consistent dividend payments, J&J is a good stock to invest in within the healthcare sector. - Amazon (AMZN):

As an e-commerce and cloud computing giant, Amazon continues to demonstrate strong growth potential, making it a good stock to invest in. - NextEra Energy (NEE):

A leader in renewable energy, NextEra Energy aligns with the global shift toward sustainability, positioning it as a good stock to invest in.

Risks to Consider When Investing in Good Stocks

While finding good stocks to invest in can lead to significant returns, it’s essential to be aware of the risks:

- Market Volatility:

Even good stocks to invest in can experience price swings due to market conditions or external events. - Company-Specific Risks:

Factors like poor management decisions or declining industry demand can impact even the most promising stocks. - Economic Conditions:

Macro-economic factors, such as interest rate changes or inflation, can affect the performance of good stocks to invest in. - Overvaluation:

Some good stocks to invest in may appear attractive but could be overpriced, limiting their potential for future returns. - Lack of Diversification:

Concentrating your investments in one sector or stock increases risk, even if they’re good stocks to invest in.

Tools for Analyzing Good Stocks to Invest In

To identify good stocks to invest in, leveraging the right tools is crucial. Here are some recommended tools:

- Stock Screeners:

Platforms like Yahoo Finance, Finviz, or Morningstar help you filter good stocks to invest in based on criteria like valuation, sector, and growth potential. - Financial News Sources:

Staying updated with platforms like Bloomberg, CNBC, or Reuters can provide insights into market trends and good stocks to invest in. - Brokerage Platforms:

Online brokers like E*TRADE or Robinhood offer research tools and analyst recommendations to identify good stocks to invest in. - Market Reports:

Reports from trusted institutions provide macroeconomic data that can guide your choice of good stocks to invest in. - Investment Apps:

Apps like Acorns or Stash make it easy for beginners to find and invest in good stocks with small amounts of capital.

Conclusion

Finding good stocks to invest in is both an art and a science, requiring research, strategy, and patience. By focusing on companies with strong fundamentals, growth potential, and a competitive edge, you can build a portfolio that stands the test of time. While there are no guarantees in investing, using sound strategies and tools can significantly improve your chances of success. Remember to stay informed, diversify your portfolio, and always assess your risk tolerance before making any investment decisions.

FAQs

- What are good stocks to invest in for beginners?

Blue-chip companies like Apple, Amazon, and Johnson & Johnson are good stocks to invest in for beginners due to their stability. - How can I find good stocks to invest in?

Use stock screeners, analyze financial statements, and monitor market trends to identify good stocks to invest in. - Are dividend stocks good stocks to invest in?

Yes, dividend stocks are good stocks to invest in for generating steady income and long-term growth. - Can good stocks to invest in still lose value?

Yes, even good stocks to invest in are subject to market volatility, economic conditions, and company-specific risks. - What is the best strategy for finding good stocks to invest in?

Combine value investing, growth investing, and diversification to identify and invest in good stocks that align with your goals.