PYPL Stock Price Dynamics

PayPal Holdings, Inc. (PYPL) has become synonymous with digital payments, offering a range of products and services that facilitate money transfers and payments. The PYPL stock price is not just a number—it’s a reflection of the company’s performance, market sentiment, and future potential. In this post, we’ll dissect various factors that influence PYPL’s stock price, providing investors and enthusiasts with a clearer understanding of its investment prospects.

Financial Performance Review

Reviewing the financial health of PayPal is crucial in understanding the movements in PYPL stock price. The company’s quarterly earnings reports, revenue growth, profit margins, and expense management are key indicators of its financial stability and efficiency. By analyzing these elements, we can better comprehend how well PayPal is positioned in the competitive landscape of digital payments.

Technological Advancements

PayPal’s commitment to innovation significantly impacts its stock price. Developments in mobile payment technology, cybersecurity measures, and user-friendly interfaces are vital. As PayPal introduces new technologies, the PYPL stock price often reacts positively to the potential of these innovations to increase market share and improve profitability.

Regulatory Impact

Regulations in the financial sector can profoundly affect PYPL stock price. Changes in policies regarding online transactions, data security, and international money transfers could either pose challenges or open up new opportunities for PayPal. Investors need to stay informed about regulatory trends to anticipate their impacts on stock performance.

Competitive Landscape

The position of PayPal within the competitive landscape of digital payment providers is another critical factor influencing PYPL stock price. The emergence of new competitors, partnerships among existing players, and market penetration strategies are all watched closely by investors for their potential impact on PayPal’s market position and profitability.

Market Trends and Consumer Behavior

Market trends and shifts in consumer behavior towards online payments and mobile banking are accelerators for PayPal’s growth. Understanding these trends is essential for predicting how they will impact PYPL stock price, especially as eCommerce continues to expand globally.

Global Economic Conditions

Global economic conditions, including recession risks, inflation rates, and currency fluctuations, play a significant role in the valuation of PYPL stock. Economic indicators such as consumer spending, unemployment rates, and GDP growth are closely tied to the performance of financial stocks like PayPal.

Investor Sentiment and Analyst Ratings

Investor sentiment and analyst ratings can cause significant fluctuations in PYPL stock price. Positive ratings and strong buy recommendations can drive the stock higher, while negative reports might lead to sell-offs. Understanding the underlying reasons behind these sentiments provides deeper insights into stock price movements.

Leadership and Strategic Decisions

Leadership decisions and strategic initiatives undertaken by PayPal’s management are pivotal. Whether it’s pursuing acquisitions, expanding into new markets, or enhancing customer service, these decisions can significantly influence PYPL stock price by shaping the company’s future direction and earnings potential.

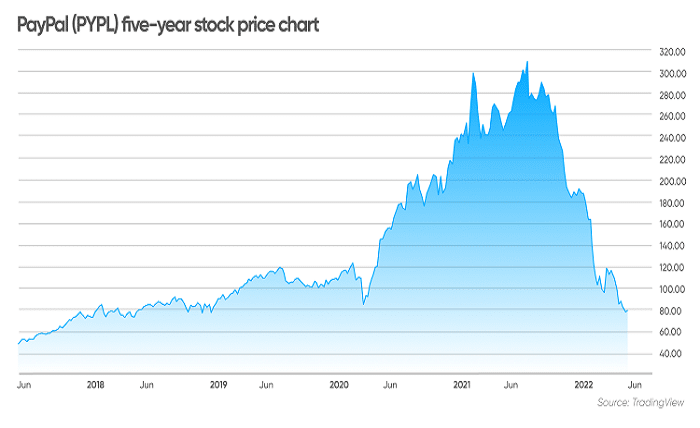

Historical Stock Performance

Analyzing the historical performance of PYPL stock helps in understanding its volatility, trading patterns, and resilience during economic downturns. This historical perspective is valuable for potential investors looking to gauge the stock’s behavior under various market conditions.

Dividend Policy and Share Buybacks

PayPal’s approach to rewarding its shareholders through dividends and share buybacks is another aspect that affects its stock price. These practices often signal the company’s confidence in its financial health and outlook, potentially attracting more investors.

Future Outlook and Projections

The future outlook for PayPal, including its revenue and earnings projections, directly impacts PYPL stock price. Forecasting future performance involves considering all the previously discussed factors to build a comprehensive picture of what lies ahead for PayPal.

Investor Tips for PYPL Stock

For investors interested in PYPL stock, it’s crucial to consider both short-term triggers and long-term trends. Understanding the balance between market opportunities and potential risks is essential for making informed investment decisions.

Conclusion

Investing in PYPL stock requires a multifaceted approach, considering financial health, market trends, competitive dynamics, and global economic conditions. By staying informed and analyzing these critical factors, investors can navigate PayPal’s stock price movements more effectively and make sound investment decisions.

FAQs

1. What factors influence PYPL stock price the most? Key factors include PayPal’s financial performance, technological innovations, market competition, and global economic conditions.

2. How does PayPal’s innovation impact its stock price? Innovative services and technologies often lead to increased market share and profitability, which positively influences PYPL stock price.

3. Can global economic conditions significantly affect PayPal? Yes, economic indicators like consumer spending and GDP growth directly impact financial stocks like PayPal.

4. How do investor sentiments and analyst ratings affect PYPL stock? Strong investor confidence and positive analyst ratings can drive the stock price up, while negative sentiments can lead to declines.

5. What should investors look for when considering buying PYPL stock? Investors should analyze PayPal’s financial health, market position, and future growth prospects, along with overall market conditions.