A Comprehensive Guide to AMT Stock: Investment Insights and Market Performance

Introduction

Investing in the stock market can be a daunting task, especially when trying to select the right stocks for your portfolio. Among the many options available, AMT stock, representing American Tower Corporation, stands out as a prominent choice for investors. This blog post delves into the various aspects of AMT stock, offering insights into its performance, historical trends, investment potential, and more.

AMT Stock: An Overview

AMT stock is the ticker symbol for American Tower Corporation, a leading independent owner, operator, and developer of wireless and broadcast communications real estate. The company is renowned for its extensive portfolio of communications sites, including towers, distributed antenna systems (DAS), and managed rooftops. Understanding the fundamentals of AMT stock is crucial for any investor considering this stock for their portfolio.

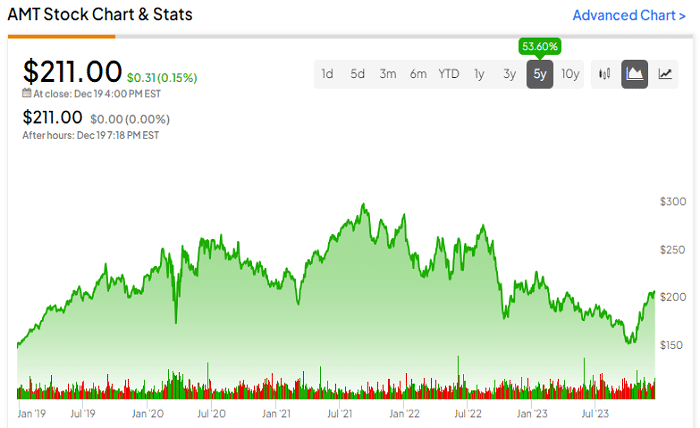

Historical Performance of AMT Stock

The historical performance of AMT stock provides valuable insights into its growth trajectory and market behavior. Over the past decade, AMT stock has demonstrated significant growth, driven by the increasing demand for wireless communication infrastructure. Analyzing past performance helps investors predict future trends and make informed decisions.

Factors Influencing AMT Stock Price

Several factors influence the price of AMT stock, including market demand for wireless communication infrastructure, technological advancements, regulatory changes, and overall economic conditions. Understanding these factors can help investors anticipate price movements and make strategic investment decisions.

AMT Stock Dividend Policy

One of the attractive features of AMT stock is its dividend policy. American Tower Corporation has a history of paying regular dividends, making it an appealing option for income-focused investors. The company’s commitment to returning value to shareholders through dividends is a significant factor to consider when evaluating AMT stock.

Analyzing AMT Stock Financials

A thorough analysis of AMT stock financials, including revenue, profit margins, and debt levels, provides a clearer picture of the company’s financial health. Investors should examine quarterly and annual reports to assess the company’s performance and its ability to sustain growth and profitability.

AMT Stock in the Context of Industry Trends

The telecommunications industry is evolving rapidly, with trends such as 5G deployment, Internet of Things (IoT), and increased data consumption shaping the market. Understanding how AMT stock fits into these industry trends is crucial for predicting its future performance and potential growth areas.

Investment Strategies for AMT Stock

Different investment strategies can be employed when investing in AMT stock, including long-term holding, short-term trading, and dividend reinvestment plans. Each strategy has its own risk and reward profile, and investors should choose one that aligns with their financial goals and risk tolerance.

Risks Associated with AMT Stock

Like any investment, AMT stock carries certain risks. These include market volatility, regulatory changes, competition, and technological disruptions. Being aware of these risks helps investors develop a risk management strategy and make more informed investment decisions.

Future Outlook for AMT Stock

The future outlook for AMT stock looks promising, with continued growth expected in the wireless communication infrastructure sector. Factors such as global expansion, technological advancements, and increased data consumption are likely to drive the stock’s growth in the coming years.

Comparing AMT Stock with Competitors

Comparing AMT stock with its competitors, such as Crown Castle International Corp (CCI) and SBA Communications Corporation (SBAC), provides a better understanding of its market position. Analyzing competitors’ performance and strategies helps investors gauge AMT’s strengths and weaknesses.

Conclusion

In conclusion, AMT stock represents a compelling investment opportunity in the telecommunications infrastructure sector. Its strong historical performance, attractive dividend policy, and positive future outlook make it a valuable addition to any investment portfolio. However, investors should be mindful of the risks and conduct thorough research before making investment decisions.

FAQs

1. What is AMT stock? AMT stock is the ticker symbol for American Tower Corporation, a leading provider of wireless and broadcast communications infrastructure.

2. Why should I consider investing in AMT stock? Investors should consider AMT stock for its strong historical performance, regular dividends, and growth potential in the telecommunications sector.

3. What factors influence AMT stock price? Factors influencing AMT stock price include market demand for communication infrastructure, technological advancements, regulatory changes, and economic conditions.

4. How does AMT stock compare to its competitors? AMT stock is comparable to its competitors, such as Crown Castle and SBA Communications, in terms of market position and growth potential. Comparative analysis helps understand its strengths and weaknesses.

5. What are the risks associated with investing in AMT stock? Risks include market volatility, regulatory changes, competition, and technological disruptions. Understanding these risks is crucial for effective risk management.