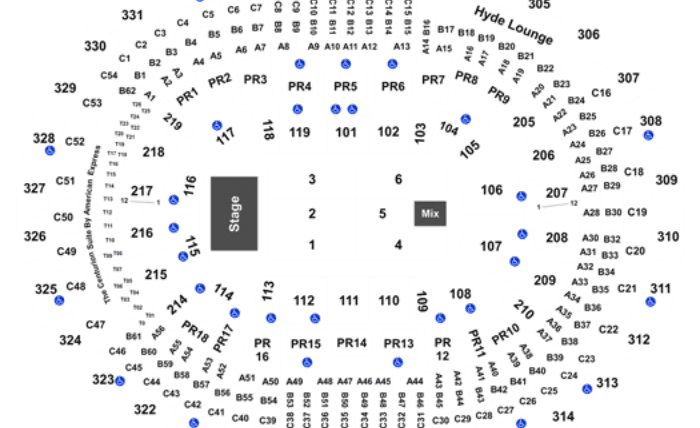

Crypto Arena Parking Map

In the bustling realm of cryptocurrency, navigating the intricate landscape requires more than just digital acumen; it necessitates strategic planning, informed decision-making, and often, a reliable map to guide enthusiasts through the crypto arena parking map. In this dynamic arena, where markets fluctuate and trends evolve rapidly, understanding the nuances of parking one’s assets is paramount. This article serves as a comprehensive guide, elucidating the significance of the crypto arena parking map and providing valuable insights to help individuals traverse this fascinating terrain.

Unveiling the Crypto Arena Parking Map

Cryptocurrency, characterized by its decentralized nature and cryptographic security, has revolutionized the financial landscape. Amidst this revolution, the concept of a parking map emerges as a crucial tool for investors and traders alike. Much like navigating a labyrinth, participants in the crypto sphere must chart their course wisely to optimize returns and mitigate risks. The crypto arena parking map embodies this strategic approach, offering a blueprint for allocating assets across various cryptocurrency platforms and investment avenues.

Understanding the Dynamics

The crypto arena parking map embodies a multifaceted approach to asset allocation, encompassing diverse strategies tailored to individual risk appetites and investment goals. Unlike traditional financial markets, the crypto arena operates 24/7, presenting both unparalleled opportunities and inherent volatility. Understanding the dynamics of this ecosystem is paramount to devising an effective parking strategy.

Embracing Diversity

Diversification is a cornerstone principle within the realm of asset management, and it holds particular significance in the crypto arena. A well-constructed parking map acknowledges the diverse nature of cryptocurrencies, encompassing established coins like Bitcoin and Ethereum and emerging altcoins with unique value propositions. By spreading investments across multiple assets, investors can hedge against market fluctuations and capture opportunities across various sectors.

Leveraging Technology

Technology lies at the heart of the crypto arena parking map, empowering investors with real-time data, analytical tools, and automated trading algorithms. From advanced charting platforms to decentralized finance (DeFi) protocols, technological innovations continue to reshape the landscape, offering novel ways to optimize asset allocation and maximize returns.

Navigating Regulatory Landscapes

Regulatory considerations play a pivotal role in shaping the crypto arena parking map. As governments around the world grapple with the implications of digital currencies, regulatory frameworks continue to evolve, impacting everything from taxation to compliance requirements. Navigating these regulatory landscapes requires vigilance and adaptability, ensuring compliance while maximizing opportunities within legal boundaries.

Crafting Your Parking Strategy

With a comprehensive understanding of the crypto arena parking map, individuals can craft a parking strategy tailored to their unique circumstances and objectives. While there is no one-size-fits-all approach, several guiding principles can inform decision-making and optimize outcomes.

Define Your Objectives

Before delving into the intricacies of asset allocation, it is essential to define your investment objectives clearly. Whether seeking long-term wealth accumulation or short-term gains, aligning your parking strategy with your overarching goals is paramount. Consider risk tolerance, investment horizon, and liquidity requirements to tailor a strategy that resonates with your financial aspirations.

Conduct Thorough Research

In the ever-evolving landscape of cryptocurrency, knowledge is power. Conducting thorough research into potential investment avenues, market trends, and emerging technologies can provide invaluable insights to inform your parking strategy. Leverage reputable sources, engage with community forums, and stay abreast of industry developments to confidently make informed decisions.

Embrace Risk Management

Risk is an inherent aspect of investing, particularly in the volatile world of cryptocurrency. Embracing risk management principles is essential to safeguarding your capital and preserving long-term wealth. Diversification, position sizing, and stop-loss mechanisms are among the tools at your disposal to mitigate downside risk and optimize risk-adjusted returns.

Stay Disciplined

In the face of market euphoria or downturns, maintaining discipline is paramount. Emotions such as fear and greed can cloud judgment and lead to impulsive decision-making. By adhering to a well-defined parking strategy grounded in sound principles and disciplined execution, investors can navigate the highs and lows of the crypto arena with resilience and composure.

Monitor and Adapt

The crypto arena is dynamic and ever-changing, requiring investors to remain vigilant and adaptive in their approach. Regularly monitor your portfolio performance, reassess market conditions, and be prepared to adjust your parking strategy accordingly. Flexibility and agility are key attributes in navigating the evolving landscape of digital assets.

Conclusion

The crypto arena parking map represents a navigational tool for investors seeking to optimize their presence in the dynamic world of cryptocurrency. By understanding the underlying principles, embracing diversity, leveraging technology, navigating regulatory landscapes, and crafting a tailored parking strategy, individuals can position themselves for success in this burgeoning ecosystem. With diligence, foresight, and strategic acumen, the crypto arena parking map becomes a guide and a pathway to financial empowerment in the digital age.