How to Invest in the S&P 500: A Complete Guide for Beginners

Investing in the stock market can be a daunting task for beginners, especially when faced with thousands of investment options. However, one of the easiest and most effective ways to begin your investment journey is by investing in the S&P 500. The S&P 500, or Standard & Poor’s 500, is an index of the 500 largest publicly traded companies in the United States. It’s widely considered a benchmark for the overall performance of the U.S. stock market. In this post, we’ll discuss how to invest in the S&P 500, why it’s a smart investment choice, and what strategies can help you maximize your returns over time.

What is the S&P 500 and Why Should You Invest in It?

Before learning how to invest in the S&P 500, it’s important to understand what the index is and why it’s so popular among investors. The S&P 500 is a stock market index that tracks the performance of 500 of the largest publicly traded companies in the U.S. These companies represent a wide range of sectors, including technology, finance, healthcare, and consumer goods.

The S&P 500 is often used as a benchmark for the overall U.S. stock market performance. Many investors choose to invest in the S&P 500 because it offers exposure to a broad range of companies, which helps to diversify their portfolio. By investing in the S&P 500, you are essentially betting on the continued growth and success of the largest companies in the U.S.

How to Invest in the S&P 500: The Basics

Now that you know what the S&P 500 is, let’s dive into how to invest in it. There are a few different ways to gain exposure to this index, and each method has its own set of benefits and drawbacks. Here are the primary options for investing in the S&P 500:

- Exchange-Traded Funds (ETFs):

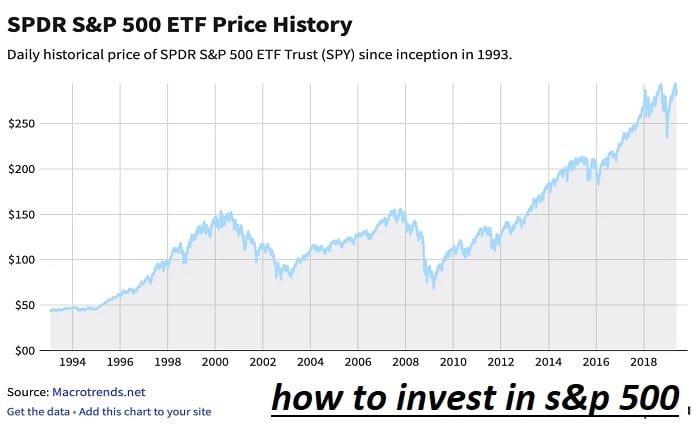

One of the easiest and most popular ways to invest in the S&P 500 is through Exchange-Traded Funds (ETFs). These funds are designed to replicate the performance of the index by holding a portfolio of the 500 companies that make up the S&P 500. The most well-known ETF tracking the S&P 500 is the SPDR S&P 500 ETF (SPY), but there are several other options as well. - Index Mutual Funds:

Another option is to invest in an index mutual fund that tracks the S&P 500. These funds operate similarly to ETFs but are bought and sold directly through the fund provider, such as Vanguard or Fidelity. Index mutual funds tend to have slightly higher expense ratios than ETFs, but they are still a low-cost investment option. - Direct Stock Purchases:

If you prefer to pick individual stocks, you can invest in the S&P 500 by purchasing shares of the companies that make up the index. However, this approach is more time-consuming and may require more effort to maintain a diversified portfolio.

Advantages of Investing in the S&P 500

Investing in the S&P 500 has several advantages, making it an attractive option for both beginners and seasoned investors. Here are some of the key benefits:

- Diversification:

By investing in the S&P 500, you gain exposure to a wide range of companies across various sectors. This diversification helps spread out risk, as the performance of one company or sector is less likely to drastically affect your entire investment. - Low Cost:

Both ETFs and index mutual funds that track the S&P 500 generally have low expense ratios compared to actively managed funds. This means you keep more of your returns rather than paying high fees to fund managers. - Consistent Long-Term Returns:

Historically, the S&P 500 has provided solid long-term returns, averaging around 7-10% annually after inflation. While past performance is not indicative of future results, the S&P 500 has proven to be a reliable way to build wealth over time. - Access to Top U.S. Companies:

The S&P 500 includes some of the most successful and influential companies in the world, such as Apple, Microsoft, Amazon, and Google. By investing in the S&P 500, you’re gaining exposure to these top performers. - Easy to Invest In:

Investing in the S&P 500 is straightforward. You don’t need to have an in-depth understanding of individual companies or sectors. You simply invest in the index, and it automatically gives you exposure to all the companies in the S&P 500.

Different Strategies to Invest in the S&P 500

There are several different strategies you can use to invest in the S&P 500, depending on your financial goals and risk tolerance. Here are some of the most common strategies:

- Buy and Hold Strategy:

This is a long-term investment strategy where you buy S&P 500 ETFs or index mutual funds and hold them for an extended period, typically several years or decades. The goal is to benefit from the overall growth of the market and take advantage of compound interest. - Dollar-Cost Averaging (DCA):

Dollar-cost averaging is a strategy where you invest a fixed amount of money at regular intervals (e.g., monthly or quarterly) regardless of the market’s performance. This approach helps reduce the risk of investing a large sum at the wrong time and ensures that you are consistently contributing to your portfolio. - Rebalancing Your Portfolio:

Rebalancing involves periodically reviewing and adjusting your portfolio to maintain the desired allocation. If the value of your S&P 500 investments grows disproportionately, you might want to sell some of them and invest in other assets to maintain a balanced portfolio. - Tax-Advantaged Accounts:

Consider using tax-advantaged accounts like IRAs or 401(k)s to invest in the S&P 500. These accounts offer tax benefits, such as tax-deferred growth or tax-free withdrawals in retirement, which can help maximize your returns over time.

How to Select the Right S&P 500 ETF or Index Fund

Choosing the right ETF or index fund is an important part of how to invest in the S&P 500. Here are some factors to consider when selecting a fund:

- Expense Ratio:

The expense ratio is the annual fee that the fund charges to manage your investment. Lower expense ratios mean more of your money stays invested, leading to higher long-term returns. Look for funds with an expense ratio of 0.05% or lower. - Tracking Error:

Tracking error refers to how closely the fund’s performance matches the performance of the S&P 500 index. A lower tracking error indicates that the fund is closely replicating the index’s performance. - Fund Size and Liquidity:

Larger funds tend to have more liquidity, which means you can easily buy and sell shares without significantly impacting the price. Look for well-established, large funds like SPY or Vanguard’s VOO. - Dividend Yield:

Some S&P 500 funds pay dividends, which are typically distributed quarterly. If you want to reinvest your dividends for compounded growth, choose a fund that offers a dividend reinvestment plan (DRIP).

Common Mistakes to Avoid When Investing in the S&P 500

While investing in the S&P 500 is generally considered a safe and reliable option, there are still common mistakes that beginners should avoid. Here are some of the most frequent errors:

- Trying to Time the Market:

One of the biggest mistakes is trying to time the market—buying and selling based on short-term fluctuations. It’s nearly impossible to predict market movements accurately, so it’s best to adopt a long-term strategy. - Overconcentration in One Asset:

While the S&P 500 offers diversification, it’s still important to diversify your investments across different asset classes, such as bonds, real estate, and international stocks. - Ignoring Fees:

While S&P 500 ETFs and index funds are low-cost investments, some funds have higher fees than others. Over time, even small differences in fees can add up, so always choose funds with the lowest expense ratios. - Not Rebalancing Regularly:

Failing to rebalance your portfolio can lead to an overexposure to one asset, leaving you more vulnerable to market volatility. Make sure to review your portfolio periodically and make adjustments as needed.

Conclusion

Learning how to invest in the S&P 500 is a great way to begin building long-term wealth. With its diversification, low cost, and potential for steady returns, the S&P 500 is a fantastic option for both beginner and experienced investors. Whether you choose to invest through ETFs, index funds, or individual stocks, the key to success is a disciplined, long-term approach. Avoid common pitfalls like market timing and high fees, and focus on strategies like dollar-cost averaging and rebalancing your portfolio. By following these tips, you’ll be well on your way to making the S&P 500 a core part of your investment strategy.

FAQs

- What is the S&P 500?

The S&P 500 is an index that tracks the performance of 500 of the largest publicly traded companies in the U.S. - How can I invest in the S&P 500?

You can invest in the S&P 500 through ETFs, index mutual funds, or by purchasing individual stocks of companies within the index. - What is the best strategy for investing in the S&P 500?

A buy-and-hold strategy or dollar-cost averaging are two popular approaches for investing in the S&P 500. - Is it safe to invest in the S&P 500?

Investing in the S&P 500 is considered a relatively safe option due to its diversification and long-term growth potential, but like all investments, there are risks involved. - How can I choose the best S&P 500 ETF or index fund?

Look for funds with low expense ratios, low tracking errors, and a good reputation in terms of performance and liquidity.