Vug Stock: An Investor’s Guide

Introduction

Vug stock, often a topic of interest among savvy investors, stands out in the financial landscape for its potential and volatility. In this blog post, we’ll delve deep into what makes Vug stock a unique investment opportunity, analyzing its past performance, current trends, and future projections.

What is Vug Stock?

Vug stock represents a segment of the market that is often characterized by its dynamic growth and technological involvement. Understanding the foundational aspects of Vug stock is crucial for any investor considering this as a part of their portfolio.

Historical Performance

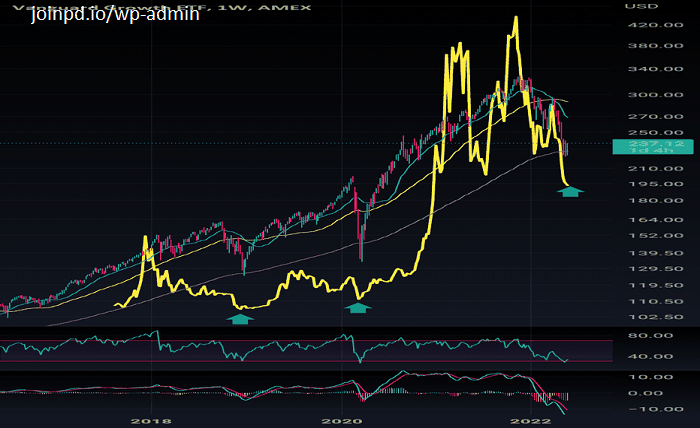

The historical performance of Vug stock has shown remarkable highs and lows, which are key to understanding its potential risks and rewards. This section explores the trends over the past decades and what it means for investors.

Market Analysis

Current market conditions play a significant role in the performance of Vug stock. This part of the post examines how economic indicators, industry performance, and global economic conditions influence Vug stock.

Investment Strategies

Investing in Vug stock requires a well-thought-out strategy. Here, we discuss various approaches, from conservative to aggressive, to help you decide how best to incorporate Vug stock into your investment portfolio.

Risk Management

Understanding and managing the risks associated with Vug stock is vital. This section covers the most common risks and provides strategies to mitigate them, ensuring a balanced approach to your investment.

Future Outlook

What does the future hold for Vug stock? This analysis looks at forecasted trends, industry growth, and potential disruptions that could affect Vug stock’s performance.

Impact of Technological Advancements

Technology plays a crucial role in the valuation of Vug stock. We’ll explore how innovations and advancements in technology could propel the stock to new heights or present new challenges.

Comparison with Other Stocks

How does Vug stock stack up against its competitors? This comparative analysis will provide a broader market perspective and help you understand where Vug stock stands in the global market hierarchy.

Vug Stock and Portfolio Diversification

Integrating Vug stock into a diversified portfolio can offer benefits and challenges. This section explains how Vug stock can complement other investments and what percentage of your portfolio it should ideally constitute.

Testimonials and Case Studies

Hearing from investors who have dealt with Vug stock can provide real-world insights. This part includes testimonials and case studies highlighting different experiences with Vug stock.

Conclusion

Vug stock offers a promising opportunity for those looking to diversify their investment portfolios with a potentially high-reward stock. However, like any investment, it requires careful analysis and strategy. Whether you’re a seasoned investor or just starting out, considering Vug stock could be a step towards achieving your financial goals.

Frequently Asked Questions

1. What is the primary appeal of Vug stock to investors? Vug stock is appealing due to its potential for high returns, particularly in sectors driven by technological advancements and innovative business models.

2. How often should I review my investment in Vug stock? Regular reviews are crucial, ideally on a quarterly basis, to adjust strategies as per the market conditions and performance of the stock.

3. Can Vug stock be a part of a retirement portfolio? Yes, Vug stock can be included in a retirement portfolio, but it should be balanced with more stable and conservative investments.

4. What are the signs that I should sell my Vug stock? Indicators might include prolonged underperformance, significant shifts in industry dynamics, or changes in your personal investment goals.

5. Where can I get reliable information about Vug stock? Reliable sources include financial news websites, stock analysis reports, and updates directly from the stock exchange where Vug stock is listed.